Bear force pushing Nifty down

Market tumbling under heavy selling pressure

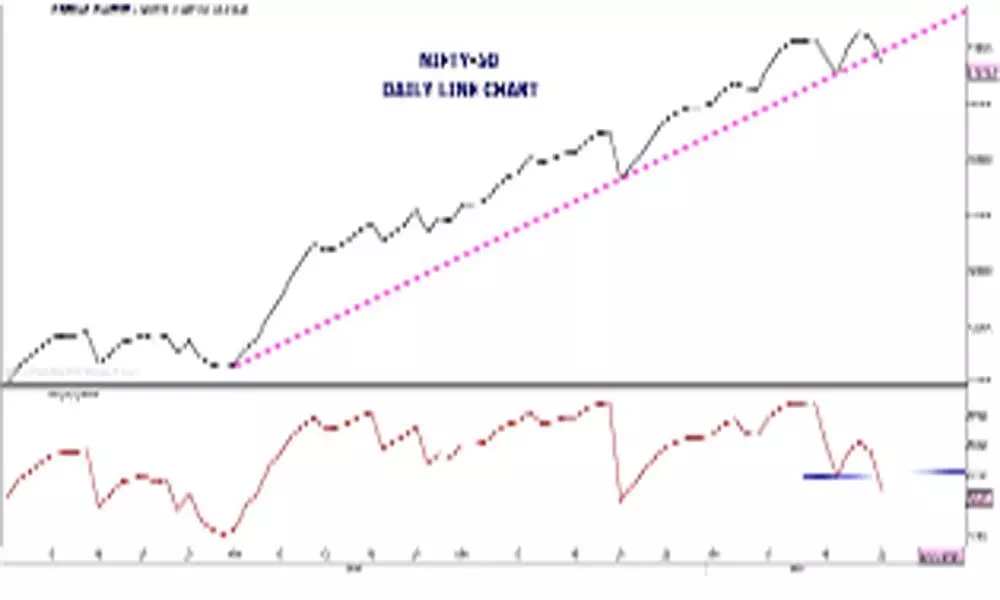

image for illustrative purpose

THE stock market tumbled with massive selling pressure. As we expected yesterday, after the late sell-off, the volatility increased. The Nifty fell sharply by 218.45 points or 1.50 per cent. This is the biggest fall after December 21. Barring, Auto and IT indices, all the sectoral indices closed in the negative zone. With the help of Bajaj-Auto's 10.4 per cent gain, the Nifty Auto index gained by 1.43 per cent. Banknifty was the worst performer with 3.17 per cent or over 1,000 point fall. The overall market breadth is extremely negative with 1,391 stocks closing in the red. Only 514 stocks were able to close with gains and 306 stocks remain unchanged. India VIX was up by 1.09 per cent.

Bears came back with vengeance.

Since yesterday, last hour, the market is completely under severe selling pressure. The Nifty fell almost 400 points or over 2.5 per cent. On a weekly chart, it formed a long-legged doji. Back to back doji candle indicating the market intermediate top. This week's long-legged doji candle also confirmed the last week's doji's bearish implications. On a daily chart, it also confirmed the previous day's evening star candle's bearish implications.

The Nifty currently is creating the double top kind of formation. It also broke down the long trend line support on a daily chart. The negative divergence in RSI has confirmed the bearishness by closing below the prior swing low. In case, the Nifty closes below the 14,281, the double formation's confirmation will emerge as a major setback for the current bull market.

The fall in the previous week does not have any negative divergence in the index. But, with today's fall, there are many possibilities unveiling before the Budget. The Union Budget may be another big trigger for the market, like last year's.

The market may replicate March 2020, in case of any disappointment in the budget proposals. On the other hand, fundamentally, the market is trading on an overstretched valuation. Unless the earnings show the dramatic growth and the economy displays a dramatic recovery, the market may not sustain at the current levels. Stay away from the new purchases and take profits, if any on the table.

(The author is a financial journalist, technical analyst, trainer, family fund manager)